Quantitative Portfolio Optimizer (Pro) app for iPhone and iPad

Developer: WisdomOne Limited

First release : 09 Oct 2012

App size: 0 Bytes

Quantitative Portfolio Optimizer (QPO) is an asset allocation tool designed for investment professionals. It simplifies and speeds up the time-consuming portfolio optimization in asset allocation process with our BI technology and our propriety iPad intuitive interface.

With QPO, investment professionals can rapidly construct a desired optimized portfolio in minutes, rather than days, based on users’ individual return requirement and risk tolerant. Once the targeted portfolio is set, users will be guarded by the auto-pilot buy/sell order suggestion module to keep their portfolio in control regardless of the market movements.

Feature highlights

* Intelligent asset search engine (Alpha, Return, Risk, Sharpe Ratio, Beta)

* Real-time portfolio tracking

* Two optimization modes for maximum Sharpe ratio or stability

* Intuitive adjuster interface for investment level adjustment

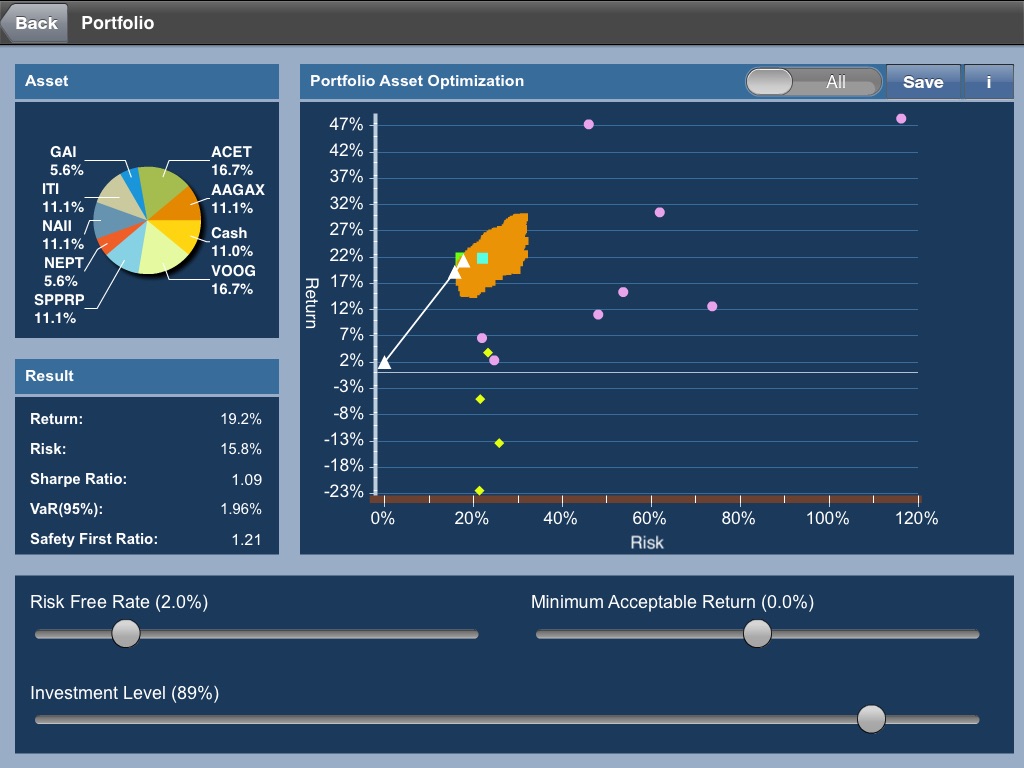

* Professional KPIs : Return, Risk, VaR, CVaR, Sharpe Ratio, Safety First ratio

* Real-time portfolio dynamic re-balancer with order suggestion

* 10,000+ investment grade US assets

* Choice of 1-year, 3-year, 5-year and 1-year data for different investment horizon.

* Integrated optimization screen with intuitive interface

* Summary charts : asset-mixes, return distribution, return-risk chart

* Intuitive iPad style navigation interface

* Fast optimization algorithm up to 20 assets

* Option to override expected return for calculation

Product Summary

Quantitative Portfolio Optimizer (QPO) is a complete intuitive system which supports the full life cycle of asset allocation process: portfolio construction, portfolio optimization, portfolio monitoring and portfolio re-balancing.

Asset Selection

The rapid asset search screen, Bull-Eye search, could locate target assets rapidly. It supports wild-card search and also by category (Stock, ETF, Mutual Fund), by capital size (Large-cap, Mid-cap, Small-cap), by sectors (Health Care, Technology etc..) ranked by return, risk, Sharpe ratio, Alpha, Beta.

Portfolio Optimization

The portfolio optimization screen shows the portfolio return-risk chart with relevant KPIs. It supports AI automatic portfolio optimization with options of top performance assets or with all assets. The optimized portfolio includes its return and risk values, and indicates the asset mixes and their weightings for visual inspection.

Portfolio Monitoring

The portfolio monitoring screen keeps track of your asset mixes with up-to-date value, and benchmarks their weighting against the targeted optimized weightings.

Portfolio Dynamic Re-Balancing

In order to limit the risk volatility due to market fluctuation, portfolio should be re-balanced from time to time. The allocation screen gives buy/sell order suggestions with real time data so as to maintain the desired targeted return and risk level by dynamic rebalancing.

Market Data

QPO data services include 10,000+ investment grade assets in US stock markets. Should you need more mutual funds, feel free to contact our customer services.

*** The product version ***

Free Version : The download comes with limited free version which allows users create 1 portfolio each with no more than 4 assets.

One time Trial Version : Users can register for the one time 2-week trial version which allows users create 3 portfolios each can have up to 8 assets.

3-month Full Version : Users can purchase the full 3-month subscription standard version which allows users can create either 5 portfolios each can have up to 15 assets, or professional version which allows users can create either 10 portfolios each can have up to 20 assets.